Free Trade Zone Regime

Click here for a courtesy call ![]()

free trade zone?

Click here for a courtesy call ![]()

advantages

• Exemption on the import of goods necessary for the operation and administration of the company’s authorized activities.

• Exemption on the import of vehicles with certain specific characteristics.

• Exemption from taxes on local purchases of goods or services necessary for the operation and administration of the company’s authorized activities.

• Exemption from export taxes.

• Exemption for a 10-year period from taxes on the transfer of real estate and municipal business licenses.

• Exemption from taxes on remittances abroad.

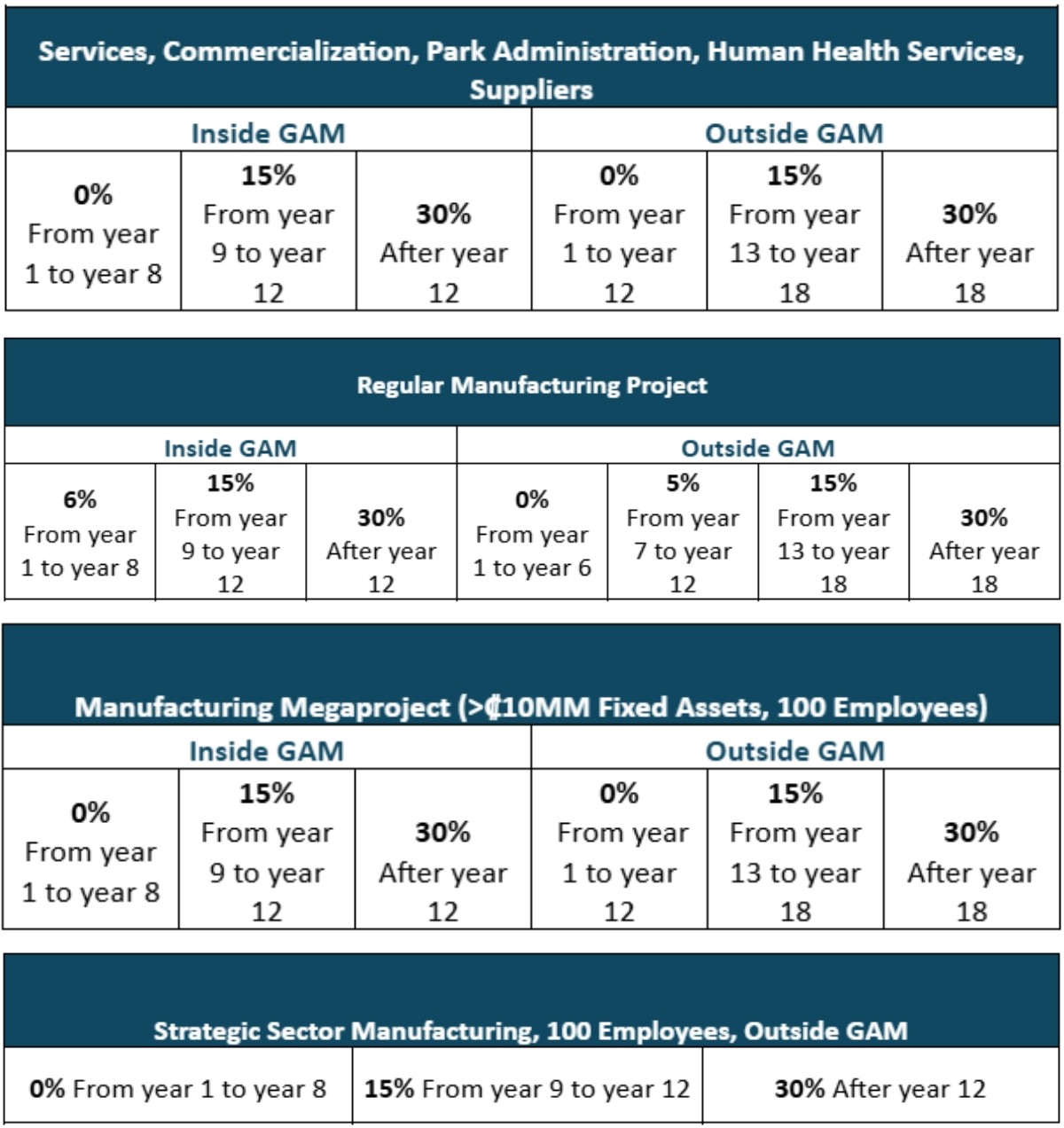

• Exemption from all income taxes, as well as any others based on gross or net profits, dividends paid to shareholders, or income or sales. This benefit is granted based on the company’s location and category.

Click here for a courtesy call ![]()

exemptions

The most significant fiscal incentive or exemption is on Income Tax:

Click here for a courtesy call ![]()

free trade zone regime

• Trading Companies: Export-oriented commercial companies that do not produce but handle, repack, or redistribute non-traditional goods and products for export or re-export.

• Service Companies: Businesses providing services to national and/or foreign individuals or entities or other Free Trade Zone companies, as long as they meet the Strategic Eligibility Index for Service Companies (IEES). They cannot offer professional services, except for human health service centers located outside the Greater Metropolitan Area (GMA).

• Park Administrators: Companies managing parks designed for the installation of Free Trade Zone businesses.

• Research Companies: Businesses engaged in scientific research aimed at improving the technological level of industrial or agro-industrial activities and the country’s foreign trade.

• Ship Construction, Repair, or Maintenance Companies: Companies operating shipyards and dry or floating docks for the construction, repair, or maintenance of vessels.

• Manufacturing Companies: Businesses that produce, process, or assemble goods, regardless of whether they are exported.

• Human Health Service Centers: Specialized service centers focused on ophthalmology, orthodontics, dentistry, cosmetic or reconstructive surgery, and high-resolution hospital entities located outside the GMA.

• Suppliers: Companies located outside the GMA providing supplies to manufacturing companies.

• Sustainable Adventure Parks: Establishments dedicated to sustainable recreational and entertainment activities or commercial activities for conservation or scientific research designed and built in a natural environment, allowing contact with nature while respecting the environment and ensuring the protection of natural resources.

Click here for a courtesy call ![]()

companies

• Company incorporation.

• Location search.

• Free Trade Zone regime application.

• Registration with the General Tax Directorate (DGT).

• Registration with the Costa Rican Social Security Fund (CCSS).

• Coordination of permits such as operating licenses, health permits, environmental, municipal, and others.

• Drafting and/or review of contracts (rental, labor, services, insurance, etc.).

• Bank account opening.

• Payroll management.

• Trademark registration.

• Immigration applications.

• Declaration of Ultimate Beneficiaries.

• Corporate tax and Education and Culture Stamp duties.

• Training on current topics.

• Any other procedures necessary for the company’s operations.

• Modifications and/or authorizations in compliance with the Free Trade Zone regime.

• Ongoing support and advice for the company’s daily operations.

Click here for a courtesy call ![]()

logistics management

Tax and Accounting Services: Our commercial partners can tailor a structure to meet the needs of each investor, ensuring the company remains compliant with its obligations.

Continuous Legal Support:

• Advice and consultancy on the Free Trade Zone regime.

• Feasibility studies.

• Application process for entry into the Free Trade Zone regime.

• Support during the start of operations.

• Procedures with PROCOMER

° Modification of the start date of productive operations.

° Adjustment of the minimum employment or investment level.

° Authorization of satellite or secondary plants.

° Expansion or reduction of areas.

° Expansion of activities and/or products.

° Relocation of facilities.

° Withdrawal from the regime.

° Annual operations report.

• Assistance and support in inspections by the National Customs Service.

• Updating auxiliary public function forms.

• Consultations related to the calculation and payment of the monthly fee.

• Guidance on asset control (physical inventory, software).

• Advice on the importance and mandatory nature of the company’s operations book.

• Guidance on controlling the entry and exit of people and goods from the company’s premises.

• Consultations on donations, destruction, waste management, and recycling processes. Support and coordination for each process.

• Preventive customs audits or audits in line with the PROCOMER Audit Manual.

• Inventory control.

• Corporate training.

Click here for a courtesy call ![]()

All Rights Reserved 2024 | Privacy